With the UK’s gas dependence fully unmasked by the Russian assault on Ukraine, it is essential that the financial and security costs associated with importing gas, and the security value of clean heating and energy efficiency, are reflected in government energy policy decisions.

The slow-motion train crash around UK gas security has been visible for many working in the energy sector for years. The country’s major reliance on gas (38% of total energy demand) and heavy and increasing exposure to gas imported from the international market meant that the gas crisis led to higher bill impacts in the UK compared to other European countries.

What is particularly surprising is the unwillingness of successive governments to tackle what is clearly one of the largest systemic challenges facing the country. This is especially difficult to comprehend because decarbonisation — the other key energy challenge beyond energy security — would naturally decimate gas demand. Roughly 85% of Great Britain’s homes currently use gas, and around half of all UK gas demand is used for heat. The deployment of energy efficiency measures, growth in renewable electricity and widespread use of heat pumps would cut gas demand to around a fifth (and possibly less) of current levels.

Announcements on new oil and gas licensing confuse the picture. Their impact on production will be limited, slowing rather than reversing import requirements. The UK continental shelf, as a fossil fuel resource, has been in terminal decline for some time.

This commentary looks to understand the issues at play, pressing the case for UK energy decision-making to ensure that gas security as well as decarbonisation is considered across all energy-related decisions.

How Did We Get Here?

Large reserves of ‘natural’ gas were discovered in 1965, leading to a government decision to exploit this resource and use it to replace the locally produced ‘town gas’ – made from coal – and to expand the UK’s gas network. Around 10 million homes in the UK have been connected to the gas grid (more than doubling connection numbers prior to 1965), and the amount used in homes has increased by around six times as gas use has moved beyond cooking and room-based heaters to whole-house central heating.

The gas network’s expansion and consolidation in the 1960s and 1970s was a state-led project that involved nationalisation of the sector. It was a huge government intervention. While the UK augmented its gas production with some imports, the country was largely self-sufficient from the 1960s all the way through to 2003, even becoming a net-gas exporter for a time in the late 90s and early 2000s.

But since 2000, production has been on a downward trajectory, and since 2004, the UK has been a net importer of gas. Today, around 50% of the gas used in the UK is imported.

Source: Based on NSTA data https://www.nstauthority.co.uk/media/9083/nsta-february-2023-production-projections-plus-ccc-and-desnz-demand-projections-v4-1.xlsx

All assessments – even some supported by the oil and gas industry – forecast ever-decreasing production; the only apparent disagreement is over how quickly gas production output will reduce, with an optimistic projection that in 2040, the UK would still be producing a quarter of current gas output. This is a terminal decline scenario. The UK’s own North Sea Transition Authority (NSTA) predicts that in 10 years, even with some new discoveries, gas production may be just one-third of what it is today. If the UK continues using the same amount of gas as it does do today, it will be 84% reliant on gas imports in 10 years’ time.

At roughly the same time that the UK became a net gas importer, in 2003, the country set a goal to cut carbon dioxide emissions by 60% by 2050. The current climate change target under the Climate Change Act is to reach net zero greenhouse gas emissions by 2050, and reaching this goal would naturally slash gas demand. But progress on decarbonising heating and deploying energy efficiency measures has been agonisingly slow.

New Gas Sources and Expanding Imports

Even with the recently announced government support for new oil and gas licenses, new production would limit, rather than reverse, a continually increasing import dependency.

Requiring liquefaction, shipping and then regasification, LNG is more energy-intensive than pipeline gas and therefore results in more costs and more climate-damaging methane leaks

Shale gas – the gas extracted from rock that has transformed the US energy market – is often touted as a solution, but the idea that it would have any significant value for the UK has been widely debunked. Even if shale gas were successful, it would likely limit the decline in imports rather than offering any potential for a major boom.

Current UK gas imports are based around liquefied natural gas (LNG) and pipeline gas, both of which are set to grow. Government data shows that Norway provided the greatest share of UK gas imports in 2022, as it has for much of the past decade. Based on the same data, the chart below shows how LNG supplies much of the remaining imports. Last year, for the first time, LNG imports from the US became the second largest source of imported gas; for the preceding years, the second largest source of imports was Qatar.

Figure 2: 2022 UK gas imports by country

Source: https://www.gov.uk/government/statistics/gas-section-4-energy-trends

Russia has historically been the biggest supplier of gas to the EU, and while Russian imports have been largely eliminated since the invasion of Ukraine, imports to the EU from Norway, the US, Qatar, Algeria and even the UK have increased.

With forecasts for ever-increasing gas import dependence, firming up additional imports makes some sense. In 2022, Centrica – energy trader and owner of British Gas – agreed to a new deal with Norway’s (mostly) state-owned Equinor to increase annual gas exports to the UK by around 10%. But imports from Belgium and the Netherlands almost totally disappeared in 2022 owing to the Russian war against Ukraine.

The UK clearly has limited sources on which it can rely for gas imports: Norway or LNG.

LNG has been invaluable for EU and UK security of supply, but it comes with financial and environmental costs. Requiring liquefaction, shipping and then regasification, LNG is more energy-intensive than pipeline gas and therefore results in more costs and more climate-damaging methane leaks. Liquefied shale gas from the US is also known to have significant production emissions associated with methane leaks. As a result, the climate change impact of LNG compared to UK or Norwegian gas is significantly greater – perhaps 20% or higher.

While the UK’s gas infrastructure has shown itself to be physically resilient, it is not economically or environmentally sustainable. The price crisis added £50–60 billion to wholesale gas costs in 2022, with obvious inflationary knock-ons associated with the price of food and other consumables. As gas import dependency continues to increase, so does the risk of international price crises.

Efficiency and Clean Energy is Energy Security

The UK’s net zero goal leaves little space for any fossil fuels, and pathways to decarbonise energy would naturally reduce the demand for gas. Plans to decarbonise heating, in part because of our import reliance, were also seen to be cost-positive even before the 2022 price crisis.

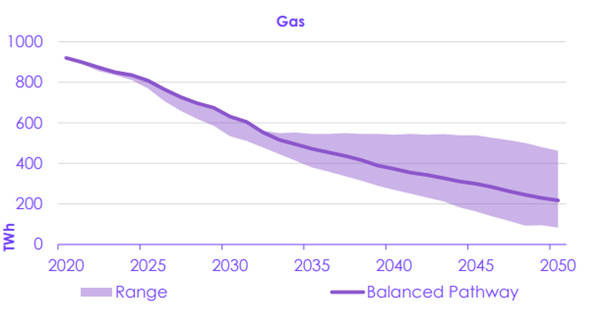

As shown below, the Climate Change Committee’s (CCC) balanced pathway would see fossil gas demand decrease by three-quarters by 2050. The general trend in this scenario is that fossil fuel use would be displaced by growing renewable electricity generation, the electrification of demands and the more efficient use of energy. Shifting away from gas towards locally produced renewable energy reduces emissions and shields the UK from international gas prices. It is notable that during the gas price crisis, retail gas prices increased significantly more than electricity prices.

Figure 3: Consumption of gas in the CCC's Sixth Carbon Budget analysis

With nearly half of UK gas currently being used for heating, cleaning up heating should be seen as a UK energy security priority. A clean heating pathway is generally expected to consist of making buildings more efficient and using heat pumps to provide the vast majority of heating, either in buildings or via centralised heat networks. The widespread burning of hydrogen for heat, proposed by some in the gas industry as a clean energy solution, would increase energy demand and likely make energy security worse.

More homes are still being connected to the gas grid, and the deployment of energy efficiency measures and heat pumps continues at a snail’s pace

The impacts of energy efficiency can be staggering:

- Insulating the walls of an uninsulated solid-walled house can reduce heat demand by 50%.

- Insulating cavity walls can reduce heat loss from homes by a third.

- Insulating an uninsulated roof can reduce heat loss by 25%.

But when it comes to cutting gas demand, the real miracle is provided by heat pumps. The vast majority of the heat from heat pumps – typically up to three-quarters – is renewable, normally coming from the ground or the air; the remainder is powered by electricity, much of which is also renewable these days. Assuming an average heat pump performance with a ‘coefficient of performance’ (COP) of three (effectively 300% efficient), based on the 2022 electricity generation mix – which was still around 38% gas – a heat pump will reduce gas demand by 74% compared to a gas boiler.

As more renewables are added to the electricity system, the already limited gas demand associated with the electricity used by heat pumps will decrease further, as will carbon emissions.

Recognising the Gas Problem

The situation is quite stark: the UK’s gas import dependency has increased from nothing to 50% in 20 years. In another 20 years, UK gas production may be negligible, even with the growth of some new gas sources. The UK’s uncomfortable gas problem, fully unmasked by the Russian assault on Ukraine, was partly recognised in the 2022 Energy Security Strategy. But policy progress has been limited. More homes are still being connected to the gas grid, and the deployment of energy efficiency measures and heat pumps continues at a snail’s pace.

Following a 2022 government commitment, rebalancing energy prices to stop rewarding gas use and support alternatives has still not happened, and should be a political priority. Electricity costs are currently burdened by historical policy costs and a carbon tax, whereas gas bills contain minimal policy and no carbon costs and are therefore effectively being subsidised. Government coordination and communication is also needed to support building owners to make their houses less reliant on imported gas.

But the energy policy process itself also needs reform. There is an ever increasing financial and security cost associated with importing gas, and that cost – just like carbon – needs to be reflected in every government energy policy decision.

The views expressed in this Commentary are the author’s, and do not represent those of RUSI or any other institution.

Have an idea for a Commentary you’d like to write for us? Send a short pitch to commentaries@rusi.org and we’ll get back to you if it fits into our research interests. Full guidelines for contributors can be found here.

WRITTEN BY

Richard Lowes

- Jim McLeanMedia Relations Manager+44 (0)7917 373 069JimMc@rusi.org