Global Survey of Private Sector Reveals Significant Proliferation Finance and North Korea and Iran Sanctions Implementation Gaps

A RUSI and ACAMS survey of sanctions professionals from across the global financial industry reveals significant gaps in private sector knowledge on proliferation finance and capacity to address North Korea and Iran sanctions.

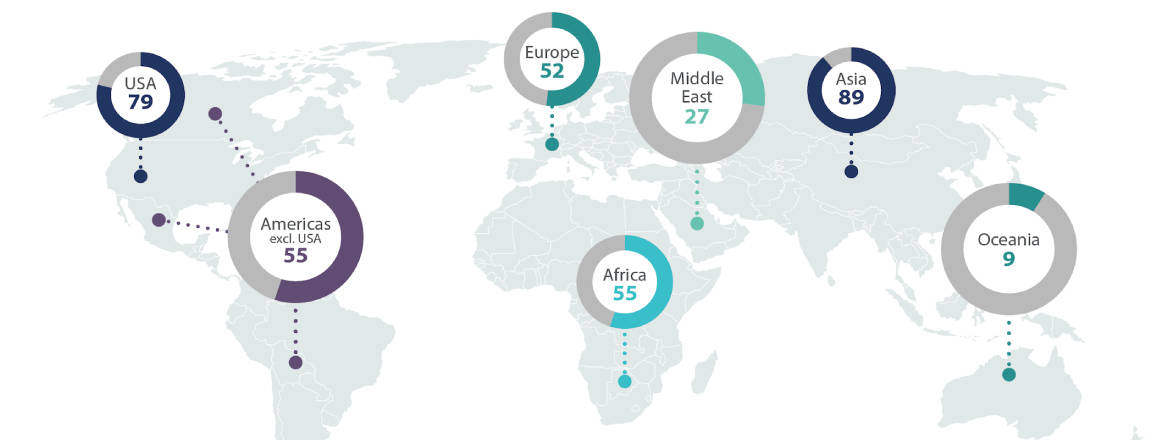

Commissioned and undertaken jointly by RUSI and ACAMS in partnership with YouGov, the survey which is based on 366 unique responses from across the global financial industry, shows that international banks are leading efforts in counter- proliferation finance, with local and national banks at greater risk of being exploited by proliferators, such as North Korea.

The survey, launched today, reveals that US banks are most exposed to proliferation risk from Iran and that few banks consult UN Panel of Experts Reports on North Korea. The study also indicated that international banks are likely to be more familiar with proliferation finance risk than national or regional banks.

Proliferation finance is the financing of weapons of mass destruction and circumvention of sanctions by proliferators, such as North Korea and Iran. RUSI and ACAMS collaborated on the global study in the fourth quarter of 2019 to get insights on attitudes and understanding of proliferation finance.

Emil Dall, Research Fellow at RUSI and co-author of the survey, said: “The results demonstrate that for many of those tasked with implementing proliferation sanctions, this is still an emerging risk. Effective counter proliferation finance controls require better collaboration between international and national banks, and more avenues for governments and private sector to share trends, red flags and intelligence to even out regional and institutional differences in knowledge and capacity.”

Justine Walker, Head of Global Sanctions and Risk at ACAMS and co-author of the survey, said: “This survey offers one of the most detailed accounts to date of how the private sector is implementing their control framework to prevent proliferators from raising, moving and using funds. The magnitude of the challenge for the compliance community should not be under-estimated. As the survey demonstrates there needs to be a greater alignment across the government counter proliferation community and those tasked with implementation. In moving forward, it is essential that the public and private sector work together to advance a mutual understanding on the different tools available, frameworks for cooperation and the implementation of a intelligence led approach.”

Key Findings include:

- 57% of respondents at international banks report that they are likely to be familiar with proliferation finance risk, compared to 35% in regional banks, 32% in national banks and 35% of non-banking respondents

- 81% respondents think proliferation finance is primarily about the procurement and financing of nuclear, chemical and biological weapons, rather than primarily about the proliferation efforts of specific state actors or non-state groups.

- Respondents based in the USA are least likely to be concerned about detecting payments related to weapons of mass destruction or implementing sanctions against Iran and North Korea, compared to respondents from other regions. Respondents from the USA are also less likely to be aware of and consult proliferation finance red flags, compared to other regions

- Two-thirds of respondents located in national banks agree that money laundering controls will detect most proliferation financing transactions (64%), which is more than double compared to respondents in international banks (31%). 33% of respondents list China as most exposed to proliferation finance risk from North Korea, followed by the United States (20%) and South Korea (10%)

- 21% of respondents list the United States as most exposed to proliferation finance risk from Iran, followed by Russia (10%) and UAE and Turkey (7%)

EXPERT

Emil Dall

Associate Fellow; Sanctions Lead at FINTRAIL