It can be inferred from the 'Reciprocal Tariffs' that the Trump administration means to end globalisation and replace it with a new nationalist order, but does that cost more than it is worth?

For long periods geopolitics and economics can seem disconnected. Weak economies can generate major wars or the threat of them. And major conflicts can leave the global economy and capital markets indifferent. But whenever there is a tectonic plate-shift in world order, then geopolitics and economics move in synch and reinforce each other.

We are living such a moment. The disruption caused by the ‘Trump 2.0’ administration will have consequences on a par with the symbolic fall of the Berlin Wall and the liberalisation of the Chinese economy but with the economic signs reversed from plus to minus.

The fall of the wall (and the concomitant liberalization of the Chinese economy) yielded three big pluses for the world: liberation of millions of people from the gulag of Soviet style economics; a liberal world order that sought to include the economies and peoples of countries like China and the former USSR into the global free market economy; and the advancement of globalisation – which did the economic job of making these people relatively prosperous.

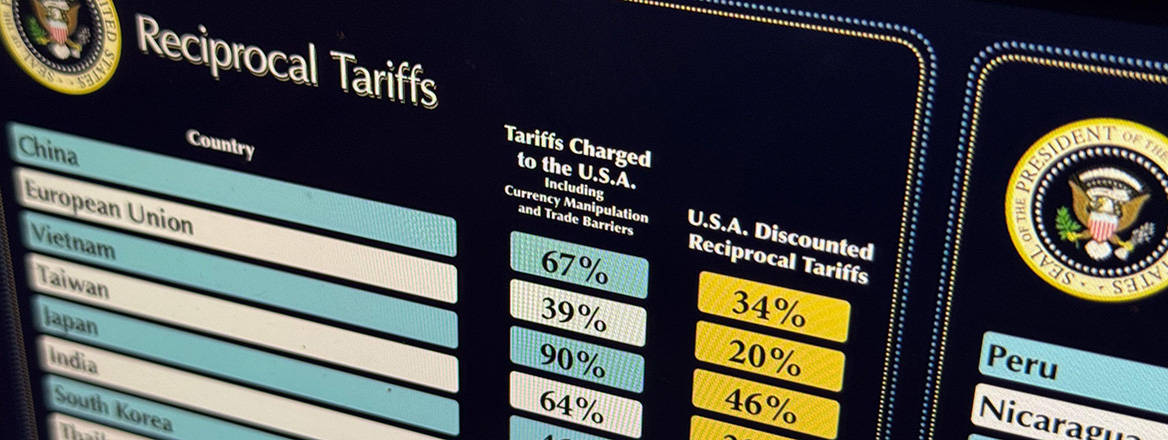

On 2 April President Trump unveiled his ‘reciprocal tariffs’. They raise the US average effective tariff rates to 25%. These are the highest US tariffs in just 100 years (the previous high in tariffs in 1930 was 40-48 percent) and are in violation of US international agreements, including the General Agreement on Tariffs and Trade (the GATT). Both points speak to President Trump’s objectives and means.

President Trump aims to do two things. One is to destroy the liberal world order and ditch the US alliances that constitute it. The second aim is to kill off globalisation and replace it with a nationalist economic model. The major tool to achieve these aims is a unified geo-economic policy which seeks to maximize economic gains.

Overall, the quality of policy is so bad that it will deepen the political damage caused by the systemic flaws in the policy itself.

It is the dual targeting of US alliances politically and globalisation economically which makes the Trump 2.0 administration so lethal.

US allies can try to separate trade, diplomacy and alliances into separate silos. But they cannot do so for long if the US is doing otherwise.

The tariffs are not negotiating tools. Trump may negotiate a deal with a few countries that ‘kiss the ring,’ but tariffs are core to Trump’s beliefs in multiple domains (not just economic). The tariffs will have major spill-over effects beyond trade.

Take the EU: beyond immediate EU retaliation, confrontation on digital regulation with the US looms. Potential disruption stemming from an unacceptable US–Russia deal on Ukraine is another potential source of disruption, one which could seal the fate of NATO.

The damage to globalisation is fatal. As globalisation was an optimised economic model, the switch – which will take years to implement – to a nationalist, isolationist economic architecture will have bad long-run effects on global growth and inflation. This means that the effects of tariffs are not ‘transient’ but of long duration.

Nor will the tariffs produce the desired effects of re-industrialising the US and curing the Federal budget deficit because:

- The US is a mature economy at the stage of development when it is natural that services replace manufacturing as a proportion of GDP – just as manufacturing replaced farming a while back! The trend for US services to replace manufacturing has been going on since the 1940’s. The trend will not reverse even if a few specific strategic sectors can be onshored.

- The US is a structural savings deficit economy. This results in a Net International Investment Position (NIIP) equal to 90% of US GDP – the highest in the world. In effect the US issues paper IOUs in the form of US Treasuries to pay for manufactured goods it does not invest to produce. That is fine as long as the USD is the global reserve currency and trading partners are willing to own it. Tariffs can disrupt the flow!

- Tariffs will not fund the budget deficit. The ‘tariff bonanza’ of $600 billion announced by Trump’s advisers ignores the impact of lower imports (due to tariffs), substitution of non-tariffed for tariffed products, and recession. Taking those factors into account could cut the tariff windfall by up to 50% while recession and Trump’s tax cuts raise the budget deficit from 6% to greater than 7-8% of GDP.

There is a final point. Policies based on misconceptions will not provide correct prescriptions. The preparatory work for the introduction of ‘Liberation Day’ tariffs is poor. For example, services are not even considered as part of trade. The disclosed formula for calculating trading partners’ ‘unfair treatment of the US’ turns out to be a spreadsheet formula (available on ChatGPT4) without any economic foundation. And the spreadsheet was such a last-minute rush-job that uninhabited islands, French Overseas Territories (an entity within the EU), Ukraine (but not Russia), and some of the poorest countries in the world (like Lesotho) were among those subjected to ‘reciprocal(!)’ tariffs.

Herein lies the hope. The execution of Trump 2.0 Tariffs and the destruction of alliances are disruptive by design and chaotic in implementation. Overall, the quality of policy is so bad that it will deepen the political damage caused by the systemic flaws in the policy itself. That may rid us of Trump’s influence sooner than we fear. But what then? Trump is a product of populism. Polarisation of US society might produce worse to succeed him. For that reason alone, there is no going back: the liberal world order and globalisation are dead.

© David Roche, 2025, published by RUSI with permission of the authors.

The views expressed in this Commentary are the author's, and do not represent those of RUSI or any other institution.

For terms of use, see Website Ts&Cs of Use.

Have an idea for a Commentary you’d like to write for us? Send a short pitch to commentaries@rusi.org and we’ll get back to you if it fits into our research interests. View full guidelines for contributors.

WRITEEN BY

David Roche

- Jim McLeanMedia Relations Manager+44 (0)7917 373 069JimMc@rusi.org